Ordering Online - Custom Duties in Thailand.

Our first experience with ordering online from Amazon, dates from many years ago :

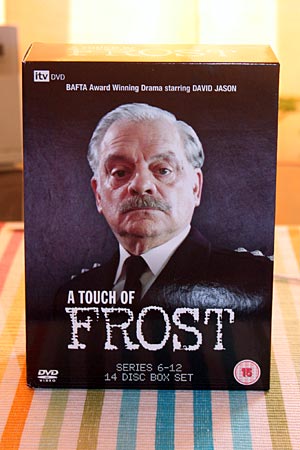

We decided to spend some money, and ordered basically all the episodes of 'A Touch of Frost', a slow paced British crime serie with some British humor and a human touch. The price, when ordering with Amazon U.K., was around 270 baht per episode (of about 100 minutes), which we found a bit pricey, but still acceptable.

The items were dispatched by 'surface' mail, and arrived within the next two weeks. The first batch comprised about 6 DVDs, and was delivered by the postman, who charged us 7 baht for his efforts.

'A Touch of Frost'. Available online by Amazon and recommended. But not coming without import duties and extra value added tax in Thailand, increasing the price by about 40 %. This DVD was of course imported many years ago now.

A few days later the main bulk of DVDs arrived (14 DVD in all) in a package weighting about 1.1 kg. We had to go and pick this up at the Phrakanong Post Office. With it came a note from Customs indicating we were to pay 900 baht in import duties (30% of the estimated value of the items) and on top of that another 300 baht of value added tax (VAT). So the price of our little online order was raised by about 40%, which was a little unpleasant surprise. Most likely the size and the weight of the package 'caused' these extra costs, which were not charged when receiving a smaller package. On the other hand, from experience in the past we know that custom charges can be rather arbritrary. We remember from ordering 'vitamins' online years back that sometimes they were delivered without any added import duties, sometimes with a rather hefty surcharge.

The above was our first experience with custom charges, when ordering something from abroad. Since then, we have imported quite a few items, most of the time without having to pay any import duties. As stated below, most goods can be imported without duties when the value is less than 1,500 Thai baht. It also helps (in our experience) that some exporters seem to indicate a lower value (like production cost ?) than what you actually paid. There likely is also some arbitrary judgment about the value of imported goods by the customs' department.

Surely, import duties all over the world, have not yet been abolished. We know that Thailand seems to be negotiating free trade agreements with various countries, and this will likely reduce import duties over time.

Maybe one advice could be : when you order a collection of items online, such as books of DVDs, have them delivered piece by piece (may cost more though), not as one bulky item. Most likely the size of the package makes the goods more likely to be charged with custom duties (and value added tax).

Interestingly, when you order something at Amazon (since a few years now), you often get charged with customs duties in advance. It can easily add 30% or 40% to the costs, and can make you to reconsider your purchase. We just recently noticed that it sometimes just depends on the price. When ordering some a small medical device (splints for our 'trigger finger'), there was no mention of custom duties. Then suddenly, when we wanted to buy 2 devices (just in case), customs duties were suddenly appearing, adding a lot to the cost, so we scaled back to just one item. It took us a while to discover this, but you may want to experiment yourself, and adjust your purchases. Nowadays, costs of transport seem to be much lower than custom duties can be ! So buying stuff divided between multiple packages, may be cheaper, though of course not correct environmentally.

The Customs Department is responsible for the collection of customs taxes and duties. The following other responsibilities are also listed on their website :

- Collection of other import and export taxes on behalf of other government agencies such as value added tax (VAT), excise tax, and municipal tax;

- Supervision of imports and exports to ensure compliance with relevant laws and regulations;

- Prevention and suppression of smuggling, tax and duty evasion including other Customs offences;

- Promotion of manufacturing and export through tax measures; and

- Facilitation of international trade.

How to find current tariff data for imports?

Go the Customs Department website ( www.customs.go.th )

Choose English language. On the right side of the entry page you will see Tariff Classification as the first menu item. On the following page (this dd. end 2020) click the image with the text (in smaller sized English language) : Integrated Tariff Database. Now you probably have to choose English language again. Click on Customs Tariff on the left of the page. On the next page there is a column which mentions (among others) the columns Document Codes and Subject. In the Subject column, click the latest available (by date) Decree, for example last time I checked it was Decree 2017. Now you look further to find the tariff rates for different items. It can be an interesting exercise.

Examples of Custom Tariffs (from a while ago, may have changed a little lately) :

Coffee 40%

Carpets 100%

Tableware, kitchenware, porcelain 80%

Nuclear Reactor (really, mentioned as such) 30%

Cars, Hearses and Prison Vans 200%

(Ambulances 30%)

Pianos 40-50%

Paintings, Drawings and Pastels 60%

Tobacco 60%

Contact lenses 35%

SLR cameras 40%

Wrist-watches 40%

Most footwear (including leather shoes, and sport shoes) 100%

Vacuum Cleaners 80%

Shavers 40%

Microwave Ovens 40%

Headphones 60%

Washing Machines 30%

Refrigerators 60% (Asean only 5%)

One can conclude from the above lists that certain items, if possible, should not be imported while in Thailand. Of course, one might need a refrigerator and microwave oven, and luckily these items may also be produced in Thailand.

On the other hand, it may be better to buy your expensive camera or wrist-watch outside the country.

One further caveat : VAT rates in Thailand are fixed at 7 % for most goods sold. In many countries (like in Europe) VAT rates may be more like something close to 25 %, negating most of a potential benefit. But surely, even then you would find much cheaper sports shoes in your home country.

The best way to find the 'correct' price of an item, is probably to do a search online and see for how much goods are sold there. Of course, you can not import them for that price, but at least you know how much you are paying more than you would possibly want to.

Further general information for sending items by Post.

Copied from the Customs website :

Category 1 Goods exempted from duty, which are goods imported by post and have Custom value, including freight and insurance charges, of no more than 1,500 baht or samples with no commercial value, which will be used for exhibition only and are not prohibited or restricted goods. For this category of goods, they will be handed over to Thailand Co., Ltd. to distribute to recipients.

Category 2 Goods liable for duty, which are goods imported by international post. This type of goods is sent from a sender/consignor to a recipient/consignee at the same time, with its FOB value not exceeding 40,000 baht, regardless of its number of packages. The goods under this category must not be prohibited or restricted goods, or goods requiring sample analysis before release. For this type of goods, Customs officers calculate its Customs value as well as duty and taxes before handing it to Thailand Post Co., Ltd., which is responsible for distributing the goods to the recipient and collecting duty and taxes on behalf of the Thai Customs Department. In this case, the recipient will receive a notification instructing how and where to collect the goods and pay for such duty and taxes.